Eamonn Brady MPSI looks at the causes, consequences, and treatment options for obesity in Ireland, plus interventions pharmacists can make

Epidemiology

Obesity is a chronic, relapsing disease and one of the most pressing health challenges facing Western countries, including Ireland. From the pharmacy counter to large hospitals, the consequences are visible daily, including more prescriptions for antihypertensives and lipid-lowering agents, rising demand for sleep apnoea assessments, and younger patients presenting with type 2 diabetes and non-alcoholic fatty liver disease (NAFLD).

The condition is not merely the result of individual choices; it is shaped by genetics, physiology, the built environment, food marketing, socioeconomic factors, and medication effects. Recognising obesity as a disease helps frame our role as pharmacists: Supporting patients with practical advice, structured weight management, medication counselling, and signposting to local HSE services.

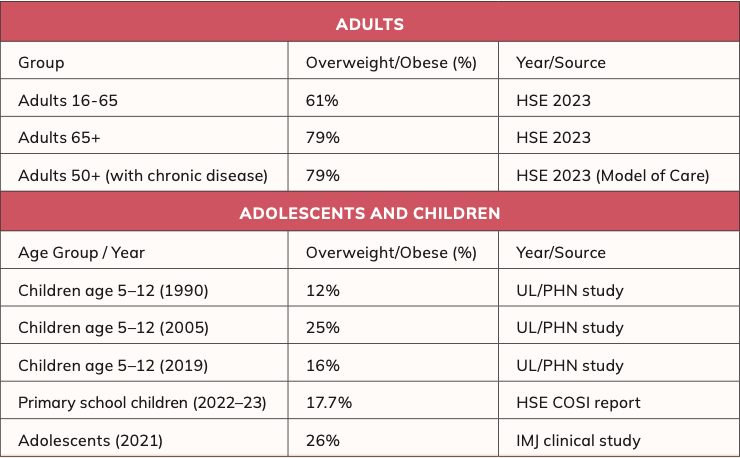

Irish data consistently show that the majority of adults are now either overweight or living with obesity, while childhood rates, although stabilising in some groups, remain a serious concern. The clinical and economic burden is substantial.

Beyond cardiometabolic disease, obesity increases the risk of several cancers (ie, breast, colorectal, endometrial), musculoskeletal disorders, depression, infertility, and complications in pregnancy. For pharmacy practice, this translates to complex polypharmacy, adherence challenges, and a need for careful medicines optimisation to avoid iatrogenic weight gain, ie, weight gain caused by medicines such as antidepressants.

Pathophysiology

Energy balance is governed by an intricate neuro-hormonal network linking the gastrointestinal tract, adipose tissue, pancreas, and brain. Key signals include leptin (adiposity signal), ghrelin (hunger hormone), insulin, GLP-1, GIP, peptide YY, and cholecystokinin. In obesity, leptin resistance and impaired satiety signalling often develop, while reward circuitry and stress pathways (via the hypothalamic-pituitary-adrenal axis) reinforce energy-dense food choices. Resting energy expenditure may decline with weight loss (adaptive thermogenesis), making weight regain more likely without ongoing support.

How is being ‘overweight’ and ‘obese’ classified?

BMI (body mass index) is weight (kg) divided by height (m) squared and is used to classify weight status in adults.

Standard adult BMI categories:

- Underweight: <18.5 kg/m2

- Healthy weight: 18.5–24.9 kg/m2

- Overweight: 25.0–29.9 kg/m2 (sometimes called ‘pre-obesity’)

- Obesity (?30.0 kg/m2), which is often broken down into:

? Class I: 30.0–34.9 kg/m2 ? Class II: 35.0–39.9 kg/m2 ? Class III: ?40.0 kg/m2

Weight and obesity rates and trends in Ireland

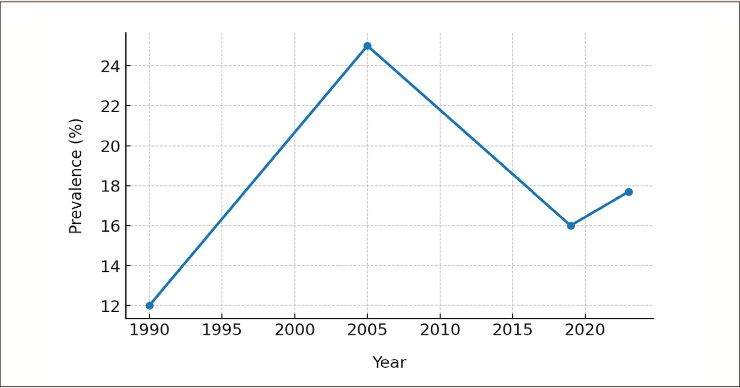

The graph illustrates a sharp rise in childhood obesity, from 12 per cent in 1990, to 25 per cent in 2005. This spike is attributed to lifestyle changes, increased consumption of energy-dense foods, and reduced physical activity. Following 2005, rates declined significantly, reaching

16 per cent in 2019, reflecting public health campaigns, school-based nutrition programmes, and increased awareness.

More recent COSI data (2022-2023) show a slight increase to 17.7 per cent, though still below the 2005 peak, highlighting ongoing concerns, particularly in disadvantaged groups.

Risk factors

- Genetic and epigenetic influences like:

? Family clustering: Obesity often clusters within families due to shared genetic factors, similar eating habits, and lifestyle patterns influencing body weight.

? Monogenic syndromes in rare cases: Mutations in a single gene, often leading to severe, early-onset obesity and associated metabolic or developmental abnormalities.

- Early-life exposures (gestational diabetes, maternal obesity, infant feeding patterns).

- Environment and behaviour (ultra-processed foods, portion sizes, alcohol, shift work, sleep debt, screen time).

- Socioeconomic factors (food affordability, unhealthy food is cheaper, access to safe spaces for activity).

- Medical drivers (hypothyroidism, polycystic ovary syndrome (PCOS), Cushing’s syndrome), and medications that promote weight gain (ie, corticosteroids, some antipsychotics, tricyclics, mirtazapine, sodium valproate, insulin, sulfonylureas, certain beta-blockers).

For pharmacists, recognising modifiable contributors like alcohol calories, sugar-sweetened beverages, and medicines that drive weight gain creates opportunities to tailor advice, liaise with prescribers about alternatives, and advise on steps that are feasible for the patient.

Health consequences

Obesity increases all-cause mortality and drives multimorbidity. Key systems affected include:

- Metabolic: insulin resistance, type 2 diabetes, dyslipidaemia, metabolic syndrome.

- Cardiovascular: Hypertension, coronary heart disease, stroke, heart failure, and atrial fibrillation.

- Respiratory: Obstructive sleep apnoea, obesity hypoventilation syndrome, asthma exacerbation.

- Gastrointestinal: Gallstones, GORD.

- Hepatic: NAFLD (non-alcoholic fatty liver disease) and NASH (non-alcoholic steatohepatitis).

? NAFLD is a spectrum of conditions where fat builds up in the liver. It ranges from simple fat accumulation (benign fatty liver) to more serious forms.

NASH is the severe subtype of NAFLD, involving liver inflammation and cell damage, which can progress to fibrosis, cirrhosis, or liver cancer.

- Musculoskeletal: Osteoarthritis (knee/ hip), chronic back pain, reduced mobility.

- Reproductive: Subfertility, PCOS manifestations, adverse pregnancy outcomes (gestational diabetes, pre-eclampsia).

- Oncology: Increased risk of breast, endometrial, colorectal, pancreatic, oesophageal adenocarcinoma.

- Mental health: Depression, anxiety, binge-eating, weight stigma and reduced quality of life.

Even modest, sustained weight loss (5- to-10 per cent of baseline) improves blood pressure, glycaemia (HbA1c), triglycerides, and NAFLD markers.

Non?pharmacological approaches

Lifestyle intervention remains first-line and underpins all pharmacological and surgical strategies.

Dietary strategies

- Emphasise minimally processed foods, adequate protein (to preserve lean mass), vegetables, fruit, wholegrains, and healthy fats.

- Reduce ultra-processed foods, refined carbohydrates, sugar-sweetened beverages, and alcohol.

- Create a calorie deficit tailored to the patient; consider Mediterranean, DASH, or reduced-carbohydrate patterns based on preference and comorbidity.

- – Practical tips: Shop with a list, do not grocery shop when hungry (hunger while shopping increases tendency to pick unhealthy food choices), cook in batches, keep healthy snacks visible, and use plate-portion guides.

Physical activity

- Build to ?150 minutes/week moderate-intensity activity plus muscle strengthening on ?2 days; higher volumes help maintenance after weight loss.

- Encourage brisk walking, cycling, swimming, resistance bands, and ‘exercise snacks’ (short bouts through the day).

Behavioral techniques

- Self-monitor (apps, diaries), set SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound), identify high-risk situations, and plan coping strategies.

- Address sleep (seven-to-nine hours), stress management (mindfulness, CBT strategies), and social support.

- Signpost to Irish supports: HSE My Healthy Weight, local Slí na Sláinte walking routes, community dietitian services, and reputable weight-management groups.

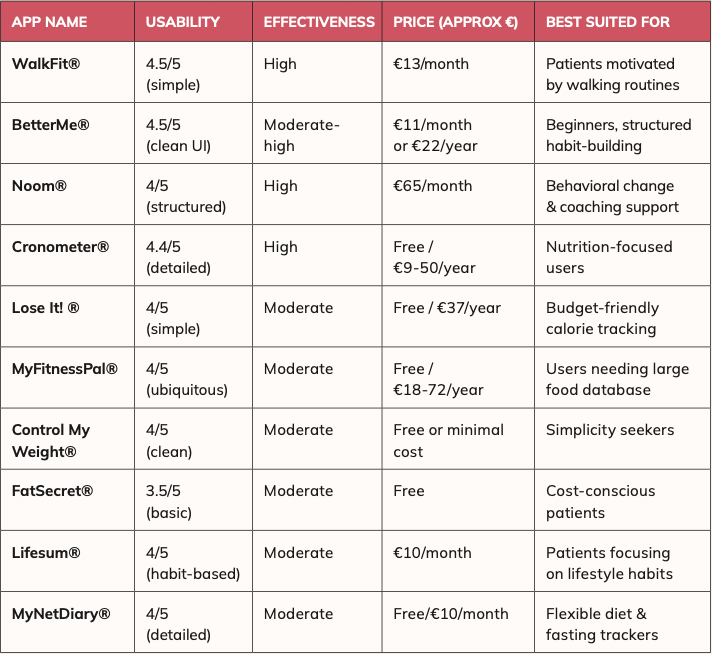

More info on weight?loss apps in Ireland:

A pharmacist’s insight Digital health tools have become an integral part of weight management, and mobile apps are among the most accessible. For Irish pharmacists, these apps offer practical support when counselling patients on weight loss and healthy lifestyles. All of the following apps are available to download in Ireland on both iOS and Android, with pricing converted

Digital health tools have become an integral part of weight management

approximately into euro (€).

WalkFit®: A walking-focused app rated 4.5/5 by users, praised for simplicity and motivating short daily workouts (8-to-11 minutes). Users report quick results, with one noting a 3.5lb loss in a week. Subscription: Approx €13/month (discounted from approx. €26).

BetterMe®: Combines fitness, meal and water tracking, mindfulness, and habit-building challenges. Rated 4.5/5, particularly suitable for beginners. Subscription: approx. €11/month or approx €22/year.

Noom®: A behavior-change app using daily CBT-based lessons and coaching. Evidence suggests significant, sustainable weight loss for regular users. Strong effectiveness but relatively costly at approx €65/month.

Cronometer®: Detailed calorie and nutrient tracker, ideal for patients needing precise macronutrient and micronutrient monitoring. Free version available; premium ‘Gold’ tier approx €9/month or approx €50/year.

Lose It! ®: Popular calorie-counting app with barcode scanning and personalisation. Free tier is excellent; premium option approx €37/year.

MyFitnessPal®: One of the world’s most widely used trackers, with a huge food database and user-friendly design. Free basic tier; premium option approx. €18/month or approx €72/year.

Control My Weight®: Simple, no-frills calorie balance app that works well for those who prefer ease of use. Often free or minimal one-off cost.

FatSecret®/Lifesum®/MyNetDiary®: All freely available in Ireland. FatSecret® is completely free; Lifesum® offers paid habit- building plans (approx €10/month); MyNetDiary® has free and premium tiers (approx €10/month).

Pharmacist take-home points on these apps

- All these apps are readily available in Ireland on both iOS and Android.

- Free tiers provide enough functionality for most patients, making them accessible regardless of budget.

- Paid versions offer deeper insights, personalised coaching, or detailed nutrient tracking.

- Pharmacists should guide patients to apps that best match their goals; whether fitness-based (WalkFit), behavioural (Noom), or nutrient- focused (Cronometer).

- Consistency and lifestyle change remain the keys; apps are support tools, not standalone solutions.

- When lifestyle measures are insufficient and BMI thresholds are met, pharmacotherapy becomes an adjunct, not a replacement.

Pharmacological treatment options available in Ireland

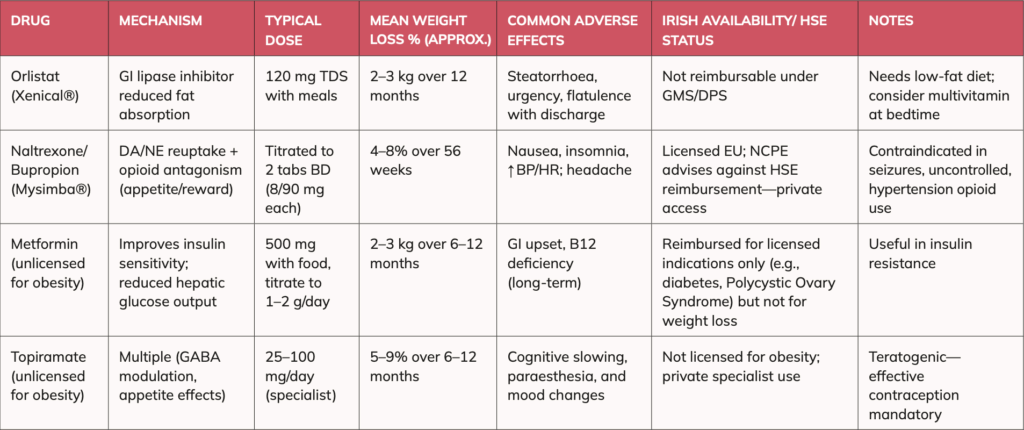

There are just two types of weight loss drugs available on the Irish market: Non GLP-1 agonists and GLP 1 agonists. I’ll talk about both, splitting into:

- Type 1: Non-GLP-1 agonist pharmacological options.

- Type 2: GLP-1 agonist pharmacological options.

Type 1: Non-GLP-1 agonist pharmacological options

Limited but clinically useful in selected patients, particularly when GLP-1s are not available, not tolerated, or unaffordable. They are rarely used, with GLP 1 receptor agonists being the most popular pharmaceutical options by far. Orlistat (Xenical® 120 mg)

Mechanism: Gastrointestinal lipase inhibitor; reduces dietary fat absorption by approx 30 per cent.

- Efficacy: Typically, 2-to-3kg more than lifestyle alone at 12 months; greatest benefit with low-fat diet.

- Adverse effects: Steatorrhoea (fatty, foul-smelling stools from fat malabsorption in intestines), flatulence with discharge, faecal urgency; mitigate with fat intake ?30% of total energy.

- Practical points: Take with main meals or within one hour post-meal; consider multivitamin at bedtime (fat-soluble vitamins). Useful in patients preferring an oral, non-systemic option.

- Irish availability/HSE: Prescription-only; Xenical® is not reimbursable under GMS/DPS (it was until 2012). Only available on private prescriptions now. Naltrexone/Bupropion (Mysimba®)

- Mechanism: Synergistic effects on hypothalamic appetite regulation and mesolimbic reward pathways.

- Efficacy: Mean additional weight loss approx. 4-to-8 per cent in trials (ie, COR-BMOD).

- Safety: Nausea, headache, insomnia, small increases in BP/HR; contraindicated if seizure disorder, uncontrolled hypertension, chronic opioid use, and eating disorders.

- Irish status: Licensed in the EU; as of 2025, NCPE advice advises against HSE reimbursement, so access is via private prescription only. Assess affordability and cardiometabolic risk carefully.

Metformin (unlicensed for weight management)

- Role: Modest weight reduction (approx. 2-to-3kg over six-to-12 months) and improved insulin sensitivity. Most commonly prescribed weight loss in PCOS, prediabetes, and metabolic syndrome, though it is rarely prescribed outside its licensed indication of diabetes. It is not allowed on LTI scheme if prescribed for weight loss; private prescriptions only, however it is an inexpensive drug.

- Counselling: Titrate slowly to reduce GI effects; consider modified-release formulations; check renal function.

Topiramate (unlicensed for weight management)

- Efficacy: 5-to-9 per cent mean loss in randomised controlled trials (RCTs) over six-to-12 months; sometimes used in specialist care.

- Cautions: Cognitive slowing, paraesthesia (feeling of tingling, numbness or ‘pins and needles’), mood changes; teratogenic (use reliable contraception).

- Monitoring: Monitor bicarbonate because topiramate can cause metabolic acidosis and low bicarbonate levels will indicate this; if unrecognised, this may lead to fatigue, kidney stones, bone effects, and impaired growth in children and monitor renal function, as topiramate may cause kidney stones and, rarely, reduced kidney function due to altered urine chemistry.

The National Clinical Programmes for Surgery (NCPS) in Ireland co-ordinates surgical services nationally, improving access, quality, efficiency, patient outcomes, and ensuring consistent standards of surgical care.

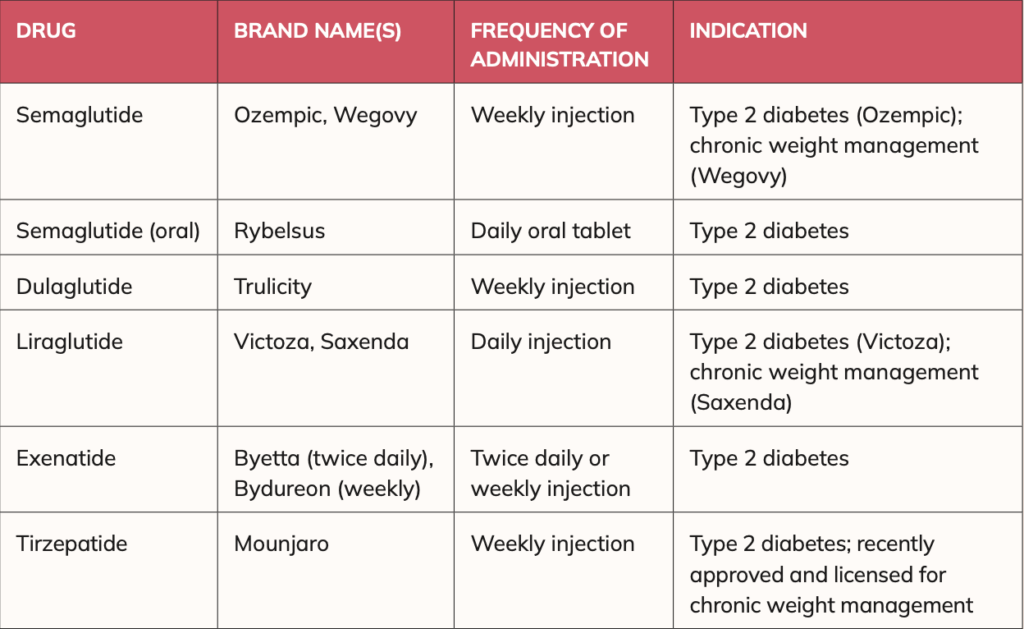

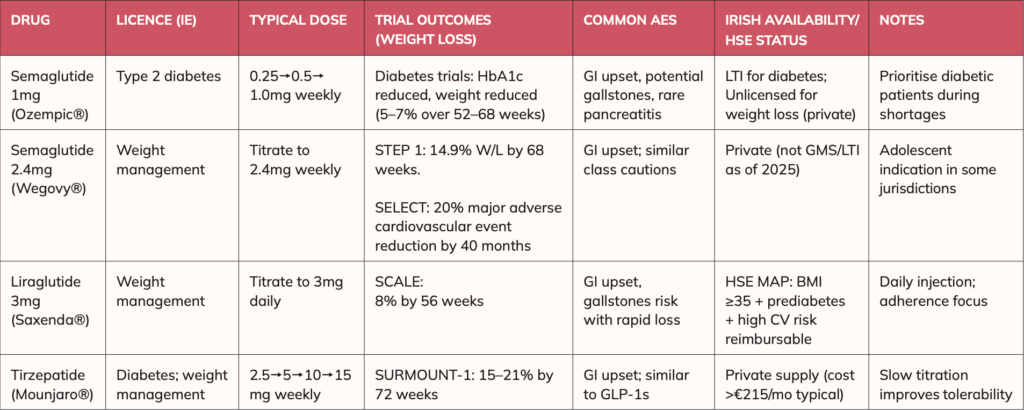

Type 2: GLP?1 receptor agonist pharmacological options

GLP-1 receptor agonist which are essentially gut-hormone agents have transformed outcomes by enhancing satiety, delaying gastric emptying, and improving glycaemic control.

Common GLP?1 medicines in Ireland (injectables and oral) The following (in table 3) GLP-1 receptor agonists are commonly used in Ireland. Most are administered by subcutaneous injection into the abdomen, thigh, or upper arm (rotating sites are recommended). Oral semaglutide (Rybelsus®) is the only tablet formulation available.

Licensing in Ireland

- Licensed for type 2 diabetes only: Rybelsus (oral semaglutide), Ozempic, Trulicity, Victoza, Byetta, Bydureon, Mounjaro.

Bear in mind, oral tablet form of semaglutide (Rybelsus) is licensed in Ireland for diabetes (not weight loss) and it has not been physically launched here yet. It is physically available in many countries including the US, UK and many bigger EU countries. Smaller markets like Ireland can be less of a priority when launching, especially as Novo Nordisk were concentrating on increasing manufacturing capacity for it. While we will see it on the market here eventually, we do not have an Irish launch date yet.

- Licensed for weight management only: Saxenda (liraglutide), Wegovy (semaglutide).

- Some brands have dual indications: Victoza (diabetes) vs Saxenda (weight loss); Ozempic (diabetes) vs Wegovy (weight loss).

All above except Rybelsus are administered subcutaneously in the abdomen, thigh, or upper arm, while Rybelsus is the oral tablet form of semaglutide (oral form of Ozempic).

For the purposes of this article, I will focus on those licensed for weight management. However, it is worth briefly noting the case of Ozempic (semaglutide), which became widely used ‘unlicensed’ for most and was commonly prescribed for weight before weight-specific formulations were available, so I will discuss Ozempic briefly too. At that time, doctors prescribed and pharmacists dispensed Ozempic extensively outside its diabetes license, given the strong clinical evidence of weight reduction and the absence of dedicated weight- loss products.

Now that Wegovy, Saxenda, and Mounjaro are formally approved for weight management, regulatory expectations have tightened, and prescribers and pharmacists are expected to adhere more strictly to licensed indications. This shift ensures safer, more appropriate prescribing and dispensing aligned with approved therapeutic use.

Supply of all these medicines can be unpredictable, though shortages have reduced since mid-2025.

GLP?1 drugs: Key Irish?market products

Semaglutide weekly (Ozempic): A GLP- 1 receptor agonist for diabetes only.

Licensed for type 2 diabetes only, not weight-loss (in Ireland and worldwide). I only discuss it here as it became so famous and in demand for weight loss as it was the first GLP-1 agonist that had an effect on weight, earning the nickname the ‘skinny jab’. Diabetic patients may access it via the Long-Term Illness

(LTI) scheme. Common adverse effects include nausea, vomiting, diarrhoea/ constipation; mitigate with slow titration and dietary advice. Caution with history of pancreatitis; and possibly thyroid history (rodent C-cell findings in trials but human relevance uncertain).

The ethics of Ozempic being prescribed or dispensed for weight loss

There is an important legal and ethical consideration in the use of Ozempic for weight loss. Ozempic is not licensed for weight loss, only for type 2 diabetes. This means that doctors must be able to justify it if challenged; this may be a challenge to explain when there is now licensed options, such as Mounjaro or Wegovy for weight management. These are more expensive to purchase privately than Ozempic. Neither is it currently funded under the standard medical card scheme for weight loss. Mounjaro or Wegovy are also not covered in State schemes (LTI scheme) for diabetes.

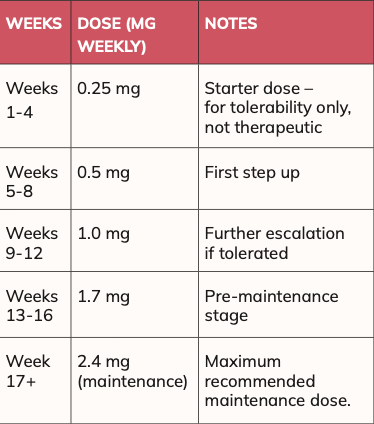

Semaglutide (Wegovy): A GLP-1 receptor agonist for weight management. Available strengths (prefilled pen, once weekly):

- 0.25 mg/0.5mL.

- 0.5 mg/0.5mL.

- 1.0 mg/0.5mL.

- 1.7 mg/0.75mL.

- 2.4 mg/0.75 mL (maintenance dose).

Administration

Wegovy is given as a once-weekly subcutaneous injection into the abdomen, thigh, or upper arm. Dose is titrated gradually to reduce gastrointestinal side- effects and improve tolerability.

Clinical evidence

STEP 1 trial (non-diabetes): Mean weight change at 68 weeks was -14.9 per cent with semaglutide 2.4mg, versus -4% with placebo (both groups had lifestyle interventions).

SELECT trial (2023): Demonstrated approx 20 per cent reduction in major adverse cardiovascular events (MACE) and significant weight loss (10-to-15 per cent) in adults with overweight/obesity and established cardiovascular disease, even without diabetes.

Irish availability and costs

Launched: Early 2025, private supply only. Reimbursement: Not covered under GMS or LTI.

Pricing: Typically, >€250 per month at starting doses; varies by pharmacy.

Liraglutide 3 mg daily (Saxenda): This GLP-1 receptor agonist is specifically licensed for chronic weight management in adults. It is administered as a once-daily subcutaneous injection, with gradual dose titration up to the full 3mg to help reduce gastrointestinal side-effects.

Evidence: The SCALE clinical programme demonstrated significant benefits, with participants achieving an average weight loss of approximately 8 per cent of baseline body weight at 56 weeks, compared with around 3 per cent in those who received lifestyle intervention alone. Beyond weight loss, the trials also reported improvements in glycaemic control, reductions in waist circumference, and modest improvements in cardiovascular risk markers such as blood pressure and lipids.

Ireland (access and reimbursement): Access is tightly regulated through the HSE Managed Access Protocol (MAP). Under this scheme, eligibility is limited to adults with a BMI ?35 kg/ m2 who also have prediabetes and a high cardiovascular risk profile. Patients meeting these strict criteria may receive reimbursement under the GMS (General Medical Services) or DPS (Drugs Payment Scheme). The MAP is intended to ensure that treatment is prioritised for those most likely to benefit and at highest clinical risk.

Outside MAP: If a patient does not meet the protocol criteria, liraglutide 3mg may still be prescribed, but only on a private basis, meaning that the full cost of treatment is borne by the patient. This restriction reflects both the high cost of therapy and the need for careful targeting in line with national policy.

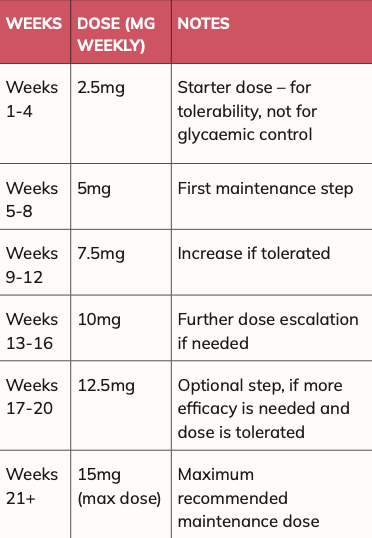

Tirzepatide (Mounjaro): A dual GIP/ GLP-1 agonist. Mounjaro is available as a once-weekly injection pen in the following strengths:

- 2.5 mg/0.5mL.

- 5 mg/0.5mL.

- 7.5 mg/0.5mL.

- 10 mg/0.5mL.

- 12.5 mg/0.5mL.

- 15 mg/0.5mL.

Starting dose is 2.5mg once weekly (for four weeks, mainly to help with tolerability). In relation to maintenance/ titration, usually increased every four weeks as tolerated, up to a maximum of 15mg once weekly.

Mounjaro is administered as a once-weekly subcutaneous injection in abdomen, thigh, or upper arm. The dosage is titrated gradually to improve tolerability and effectiveness. The following schedule is commonly used:

In the SURMOUNT-1 study, approximate mean weight change at 72 weeks was 15 per cent for 5mg weekly doses, 19.5 per cent for 10mg weekly dose, and 20.9 per cent for 15mg weekly dose vs ?3.1 per cent with placebo (lifestyle background). Irish launch occurred in February 2025; currently private supply with typical monthly costs >€250 at starting doses in pharmacies; price varies by pharmacy.

General GLP?1 counselling

Eat slowly, stop at first sign of fullness, separate fluids from meals if reflux occurs, prioritise protein to preserve lean mass, maintain resistance exercise, monitor for gallstone symptoms with rapid weight loss, and review interacting medicines (ie, delayed gastric emptying may alter absorption of some oral drugs). Avoid in personal/family history of medullary thyroid carcinoma or MEN2; caution with pancreatitis history.

Are Mounjaro and Wegovy likely to become available on the medical card (for weight loss)

or LTI scheme for diabetes?

The National Centre for Pharmacoeconomics (NCPE) evaluates the clinical and cost-effectiveness of medicines in Ireland, informing reimbursement decisions to ensure fair, evidence-based, and sustainable healthcare access.

The National Centre for Pharmacoeconomics (NCPE) is considering Mounjaro and Wegovy for reimbursement on State schemes for both weight loss and diabetes, with a decision on Mounjaro expected by early 2026. In my opinion, it is unlikely Wegovy will be approved anytime soon on State schemes as it contains semaglutide (like Ozempic), but it is far more expensive than Ozempic. In my opinion, Mounjaro stands more of a chance of being approved on State schemes as it achieves greater weight loss and slightly better blood sugar control.

Pharmacists’ role in obesity management

Community pharmacists in Ireland are ideally placed to identify risk, initiate brief interventions, and support sustained behaviour change. Key practice components include:

- Screening and conversation starters: Opportunistic BMI/waist checks, BP, HbA1c (where services exist), and sensitive language (ie, ‘people living with obesity’).

- Medication review: Flag agents that promote weight gain; suggest alternatives (ie, SGLT2 inhibitors

or GLP?1s for suitable diabetics; weight?neutral antidepressants where appropriate).

- Counselling on pharmacotherapy: Dosing/titration, expected weight?loss timelines, plateau management, and discontinuation rules (ie, stop if <5% at three?to?six months depending on agent/guideline).

- Safety monitoring: GI side?effects, dehydration, gallstone symptoms, mood changes, hypoglycaemia risk when combined with insulin/sulfonylureas.

- Scheme navigation: Explain LTI

As thinner bodies become the norm, cultural perceptions of health and attractiveness

will evolve

(diabetes), GMS/DPS coverage, and Saxenda MAP eligibility; clarify that Wegovy and Mounjaro are currently private.

- Relapse planning: Normalise weight cycling, schedule reviews, and maintain resistance exercise and protein intake after weight loss to preserve lean mass.

Longer term non?pharmaceutical impacts of widespread GLP?1 agonists and the resulting lighter population

The widespread adoption of GLP? 1 agonists (such as liraglutide, semaglutide, and tirzepatide) for weight management could transform not only healthcare but also society, industry, and daily life. This trend is likely to accelerate further as patents expire, making treatments less expensive, as more versions become available, and as alternative forms such as oral tablets (in addition to injections) make them more convenient for patients.

Below are some likely non? pharmaceutical changes that would result if populations become lighter and obesity rates significantly decline.

1. Healthcare system shifts

- Reduced burden of chronic disease: Fewer cases of type 2 diabetes, cardiovascular disease, and joint disease.

- Healthcare cost savings: Less long? term expenditure on obesity?related hospitalisations, though drug spending may rise initially.

2. Food and beverage industry

- Lower demand for indulgence foods: Potential decline in fast food, snack, and confectionery sales.

- As enjoyment of food is something many find, it could mean less demand for restaurants or even takeaways as people just don’t have that ‘same enjoyment’ with food they once had.

- Rise of protein and nutrient?dense foods: Industry pivots towards healthier, smaller meals.

- Alcohol consumption may fall: Many GLP?1 users report reduced cravings for alcohol.

I can confirm a few patients in my practice confirmed this regarding cravings for alcohol reducing, plus when they do drink, they feel fuller quicker.

3. Fitness, leisure and lifestyle

- Increased physical activity: Lighter individuals may engage more in gyms, sports, and outdoor activities.

- Fashion industry changes: Clothing size ranges may shift as fewer consumers require XXL sizes.

- Travel and transport: Airlines could save fuel, and seat sizes may gradually be redesigned.

4. Workplace and productivity

- Lower sick leave: Reduced obesity? related illness leads to fewer absences. ? Insurance benefits: Employers and employees may benefit from lower health and life insurance premiums.

5. Social and cultural effects

- Changing attitudes to weight: Reduced obesity prevalence may lessen stigma but could introduce new pressures.

- Beauty standards: As thinner bodies become the norm, cultural perceptions of health and attractiveness will evolve.

6. Economic implications

- Pharmaceutical boom: GLP?1 agonists dominate obesity treatment, reshaping pharma markets.

- Sectoral ripple effects: Junk food sales may decline, while wellness, health food, and fitness industries grow. ?

References on request

Disclaimer: Brands mentioned in this article are meant as examples only and not meant as preference to other brands.

Written by Eamonn Brady MPSI (Pharmacist). Whelehans Pharmacies, 38 Pearse St and Clonmore, Mullingar. Tel 04493 34591 (Pearse St) or 04493 10266 (Clonmore). www.whelehans.ie. Eamonn specialises in the supply of medicines and training needs of nursing homes throughout Ireland. Email info@whelehns.ie