Analysis of locum market contains data from thousands of completed shifts between May 2024 and May 2025

The Clarity Locums Analysis of Locum Market May 2025 report was released recently, reflecting significant fluctuations in locum rates over the past year due to changing market dynamics and seasonal demands. The report also digs deeper into locum rates, specifically the factors that lead to higher or lower rates and offers advice for pharmacists on how they can be as costefficient as possible when hiring locums. Trends in the locum market have varied over time, and this is detailed in the report, which cites “wider issues relating to the overall market”. “It is important to view your requirements in terms of the entire labour market, rather than in terms of your account,” state the authors. “For instance, even if you are listing days within the guidelines of this report, there may be a number of clients listing days at very short notice on a consistent basis in your locality, which facilitates and ultimately actively incentivises locums to wait until the last minute to book work. This will diminish the savings that you will experience, irrespective of your own behaviour.”

Price

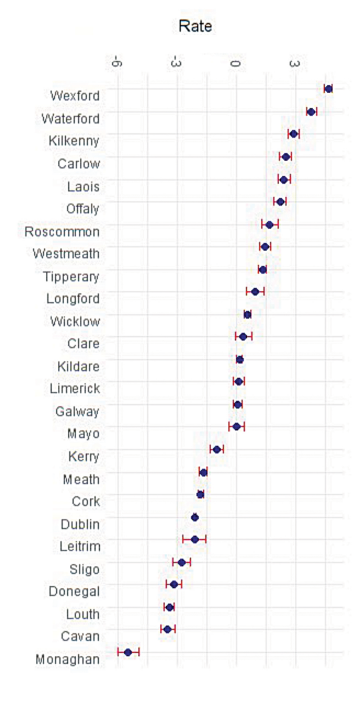

The authors use what they term a “marginal effect regression analysis”. This employs examination of the features that influence the market and the knockon effect on price. One of these is the time of the week, and it is shown that there is no difference between Tuesdays, Wednesdays, and Thursdays. Mondays and Fridays are slightly more expensive. For example, there is a maximal difference of approximately €8 between Tuesdays and Saturdays. “It would be worthwhile maximising booking during the week due to locum supply and pharmacy demand differentials,” the report states. The report also looks at lead-in times, pointing out that as you get closer to the booking day, the effect of booking later does tend to increase the rate. Shorter notice does mean less pharmacist availability, the authors point out. “The costs do accelerate as one gets inside a week before the booking,” the report states. “With this in mind, the optimal strategy would be to book a month in advance or as soon as possible.” It also suggests that there is an apparent preference from locums to begin their shift earlier. This is partly influenced by the opportunity to work longer hours for a particular shift, and more locums seem to prefer to begin earlier. There are also regional differences between different counties related to the supply and demand and availability of locums, as well as demand from pharmacies, which is shown in Figure 1.

Wages

The report goes on to discuss why pharmacist wages have increased over the past number of years, and what has precipitated decreases in rates over the past 18-to-24 months. From 2014 to 2019, there was a rise in wages overall, regardless of the sector, which saw pharmacists’ wages increase from what was already “a relatively high baseline”. This was accelerated by a number of factors, including: Increased access to graduate entry medicine in the Republic; introduction of third-level fees of up to £9,000 per annum in many UK schools of pharmacy (severely affecting a point of access for many leaving certificate students); introduction of the 7 IELTS minimum requirement to join the register; trends in global consolidation in the independent sector, with many single independent proprietors leaving the profession following their business’s acquisition; increased regulatory and compliance standards and reduction in net profit per item; and the recent restructuring of the MPharm/Intern year, which the report says “has disrupted the long-established year-long community internship that was a rite of passage for many pharmacists”. The authors also note “the increased casualisation” of work, with career paths becoming less defined, which has resulted in an increase in access to temporary employment in markets where temporary employment was previously less available. In the past 10 years, growth in the pharmacy market has seen a rise in the number of, and demand for, locums. Mr Anthony O’Neill, Managing Director of Clarity Locums, wrote: “Our analysis reveals a distinct cyclical pattern in pharmacist hourly rates, with summer months commanding premium compensation. Locum pharmacist rates peaked in August 2024 at an average of €57.66 per hour, representing a 24.2 per cent increase from the annual low of €46.43 observed in March 2025. This seasonal variance appears consistently linked to increased demand during holiday periods when permanent staff typically take leave, creating workforce shortages.”

Technicians

On Technician rates, he commented: “Technician rates, while following a somewhat similar pattern, demonstrated more modest fluctuations, ranging from €17.22 to €19.25 per hour over the analysed period. Notably, technician rates showed greater stability and a general upward trajectory in 2025, with average rates increasing by 11.8 per cent from July 2024 to April 2025. “The data indicates a substantial wage differential between the two professions, with pharmacists earning on average 2.38 times the hourly rate of technicians. This gap reached its maximum in August 2024 (2.89x) and its minimum in January 2025 (2.19x), suggesting periodic shifts in relative value perception between these complementary roles.”

Demand and mobility

The pandemic and lockdowns resulted in an unprecedented demand for pharmacy staff, coupled with decreased mobility. This was unsustainable, and the marked reduction in demand for locum pharmacists has been mirrored in the UK. The report predicts further reductions in locum rates in the second half of 2525 and into 2026, and will be compounded by the autumn and winter months. These reductions in demand will be fuelled by four major factors, says the report. These are: Ongoing improvements in pharmacies’ ability to attract and retain full time employees, and a sustained increase in the availability of overseas candidates for full-time roles; more pharmacists gravitating towards full-time employment due to the cost of living crisis; reduced new pharmacy openings and ownership transactions; and the addition of three schools of pharmacy, resulting in 80-to-90 new graduates per annum.