The illicit e-vapour market is valued at 47 million litres, equivalent to 605 billion sticks, and accounts for three-quarters of total e-vapour volume globally, data analytics company Euromonitor International has revealed.

According to the World Market for Nicotine 2025 report, the rise of single-use products has driven the illicit market, with 89 per cent of disposable e-vapour volumes being illicit globally, estimated at the equivalent to 235 billion sticks for 2024.

Erwin Henriquez, head of nicotine at Euromonitor International, said: “The main driver behind the growth

of the illicit market is a combination of overly restrictive legal frameworks that create a marked disparity between compliant and non-compliant products, insufficient enforcement, and a value gap that leads consumers to opt for illicit goods that are more convenient and affordable.”

As a result of complex regulations and a mismatch between consumer demand and the legal products available, the illicit e-vapour market is now valued at USD$47 billion, with 71 per cent of illicit volumes sold in regulated markets.

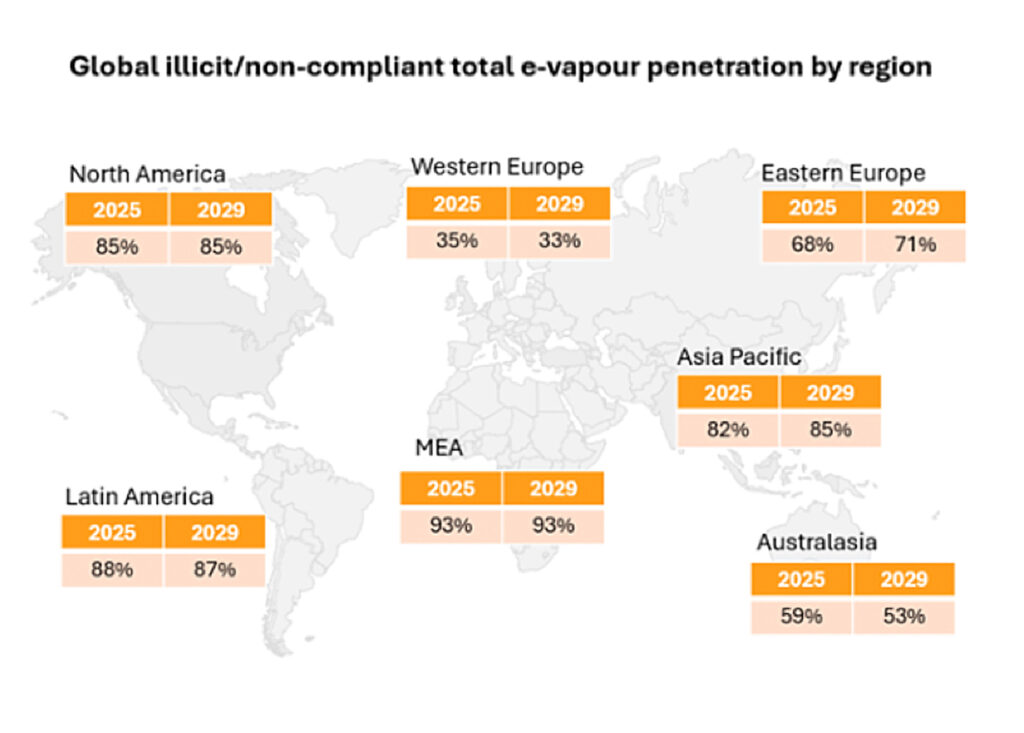

The penetration of illicit e-vapour products is high across the board. North America, Latin America, the Middle East and Africa and Asia Pacific all exceeding 80 per cent. Western Europe is particularly noteworthy due to its relatively low penetration rates and increasing legislative pressures.

The US leads in illicit e-vapour volume, but the Middle East, Africa and Latin America have the highest market penetration. Regulatory gaps in MEA, from strict bans to no frameworks, drive 32 per cent of global illicit volume. Legalisation in Latin America, led by Argentina, could reduce illicit activity, with Brazil and Mexico showing potential.

There remains limited awareness among consumers and retailers about illicit e-vapour products. Many are unable to distinguish between legal and illegal or non-compliant products offerings, particularly in terms of product safety, regulatory compliance and market legitimacy. Governments and industry stakeholders must work to increase awareness of the illicit trade, as has been done with illicit cigarettes.

The total e-vapour market accounts for 13 per cent of the nicotine industry, with the volume impact of illicit e-vapour now comparable to the size of illicit cigarettes. This reflects a shift towards alternative products as consumer preferences evolve alongside regulatory changes.

Henriquez added: “The global use of e-vapour products is rising as health- conscious consumers seek reduced-risk options. Despite the challenges, there are opportunities for companies and governments to convert illicit users to the legal market.”

E-commerce and social media have introduced new challenges for regulatory enforcement, enabling consumers to access non-compliant products easily, which may be shipped across borders. As social commerce emerges as a distribution channel for e-vapour products, effective regulation becomes increasingly crucial to prevent existing rules from becoming ineffective, he said.